In the 1800s, the British Empire was at its zenith. It’s remarkable to think how a damp little archipelago off Europe’s northwest coast came to rule a quarter of the world’s population and an equally vast portion of its landmass. Nowhere was this more evident than in British India, where a mere 1,000 civil servants were tasked with governing over 400 million people.

Of all the challenges faced by British colonial rulers, you'd hardly expect snakes to be a major concern. But, as fate would have it, the Brits became worried about the number of deadly cobras slithering through the streets of Delhi. So, they hatched what seemed like a genius plan: pay locals a bounty for every dead cobra handed in!

And sure enough, the plan worked—at first. Cobras vanished from the streets. But as the supply of wild cobras dwindled, some entrepreneurial locals started breeding cobras just to cash in. When the British caught wind of this, they abruptly cancelled the programme. Left with a load of now-useless cobras, the breeders did the only thing they could—they let the snakes loose. The end result? Even more cobras slithering around Delhi than before the scheme began. Thus, the Cobra Effect was born. More on this phenomenon later…

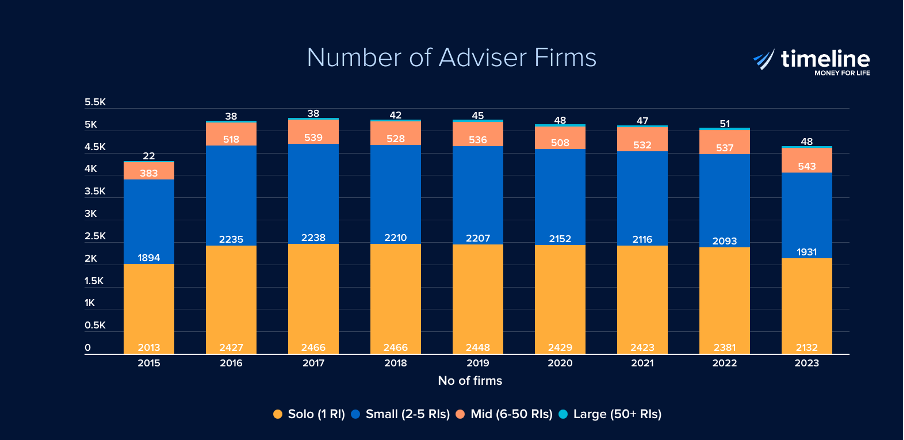

Much has been said about the pace of consolidation in the UK adviser market, largely driven by private equity awash with debt-fuelled capital over the past decade or so. For the first time since the Retail Distribution Review (RDR), 2023 saw a marked reduction in the number of small and medium-sized adviser firms.

- Solo Firms: The number of solo adviser firms shrank by 334 (a hefty 13.5%) in the past five years, with 249 of those disappearing in 2023 alone.

- Small Firms (2-5 advisers): These firms dropped by 162 (7.7%) in 2023, with a total loss of 279 (12.6%) in the last five years.

- Mid-sized Firms (6-50 advisers): The only group bucking the trend, mid-sized firms grew by 1% (6 firms) in 2023 and 2.8% (15 firms) over five years.

- Large Firms (50+ advisers): If you think the big players were immune, think again. They saw a 6% reduction in 2023, although the number of large firms has actually grown by 14% (6 firms) in the past five years.

In total, 613 solo and small firms have vanished in the last five years—a decline of 11.3%, with over 8% disappearing in 2023 alone. But why?

"PE backed consolidation, of course!" I hear you mutter. Well, maybe... but while that is the answer often trotted out by consultants, all is not as it seems...

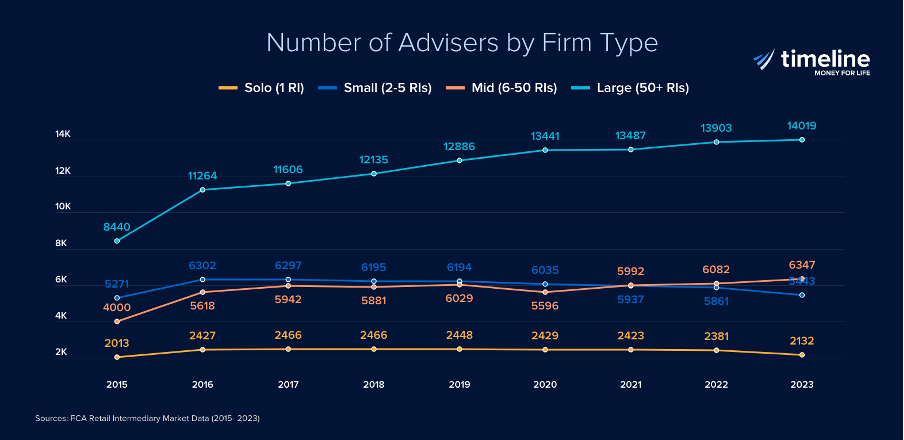

The real issue isn't just the reduction in firms; it’s the number of advisers.

- A net of 1,086 advisers have exited solo and small firms in the past five years.

- Mid-sized firms saw an increase of 466 advisers in the past 5 years, more than half (265) in 2023 alone.

- While large firms grew their adviser numbers by 15% in the past 5 years, 2023 was their worst with only 116 net new advisers that year!

The result? A 12% decline in solo and small firm advisers in five years, while mid-sized firms gained 466 advisers and large firms added 1,884.

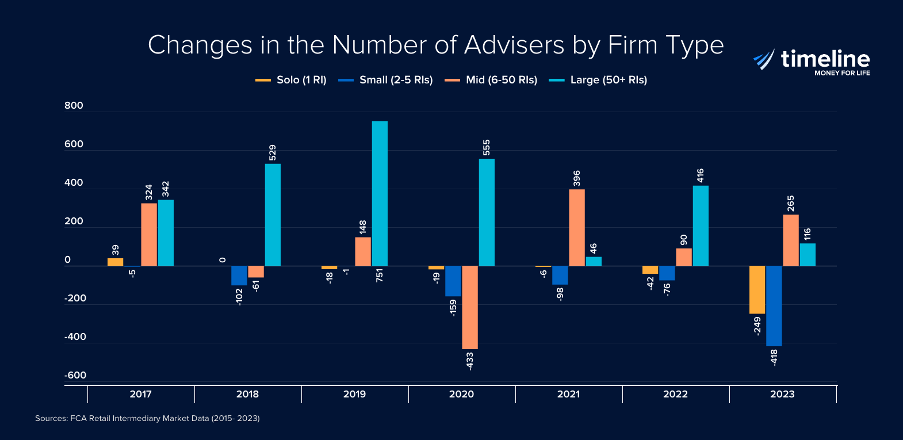

There’s no doubt that PE-backed consolidators have been snapping up solo and small firms in recent years. But with acquisitions slowing in 2023, why did the number of advisers in small firms plummet markedly that year, at nearly 4 times the previous 3 years combined? Let’s dive deeper into the numbers.

There were just 48 UK firms with more than 50 advisers in 2023, split between consolidators and networks. According to Citywire data, 21 of 36 consolidators had over 50 advisers. Collectively, these consolidators account for 4,889 advisers. Among networks, 14 of the top 25 had more than 50 advisers.

So, while solo and small firms lost 667 advisers in 2023, large firms only gained a net of 114—a growth of less than 1%.

Let that sink in. Despite all the acquisitions and recruitment efforts, five times more advisers left solo/small firms than joined large firms in 2023. Why?

Two explanations:

- The Earn-Out Period Effect: There’s a 2-3 year lag between when advisers sell their businesses to consolidators and when they officially drop off the radar. With the bulk of acquisitions happening between 2019 and 2022, many advisers likely completed their earn-out periods in 2023 and happily sailed off into the sunset.

- The Rise of The Breakaway Adviser: Non-equity-owning advisers in acquired firms are starting to break away to set up their own businesses, likely using networks to fast-track the process. This could explain why 2023 was one of the best years for networks in recent memory.

Consolidators now face a talent war. With many equity-owning advisers in remaining solo and small firms uninterested in joining them, and consolidators not exactly setting up adviser academies up and down the country, they’re struggling to replace retiring and breakaway advisers.

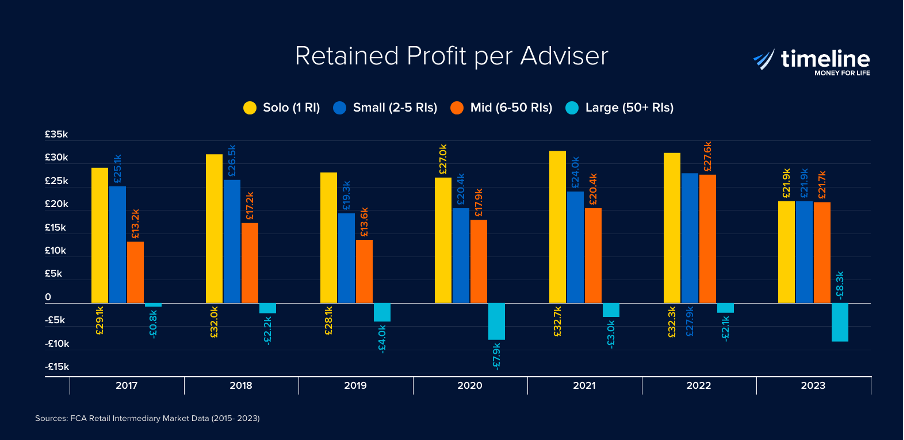

To make matters worse, consolidators aren’t investing enough in technology or operational efficiency to offset these challenges. And while adviser productivity declined across the board in 2023, the numbers show that large firms are lagging behind.

- The average retail investment revenue per adviser in large firms is £188k, only marginally higher than solo firms, while small firms boast a much healthier £212.7k

- And what about profitability? Large firms lose an average of £11k per adviser, compared to a profit of £75.3k per advisers for small firms and £45.5k for medium-sized firms. Even when you factor in that small firm advisers are likely to take more of their compensation in dividends rather than salaries, the retained earnings per adviser in small firms are comparable with mid-sized firms and far exceed those of large firms.

The trouble for PE backed consolidators is that, with retiring advisers and the breakaways poaching top clients, they’re left with less experienced staff, overworked advisers, and underserved clients. A talent war is brewing, and with most small firm advisers holding equity in their own firms, recruitment isn’t getting easier.

The Cobra Effect strikes again.

Here’s the rub: Consolidators face a cocktail of lower productivity, overworked advisers, and underserved clients that will accelerate the rise of breakaway firms! Just as the cobra bounty programme backfired on the British in Delhi, consolidators face a similar unintended consequence in the adviser market. The more they acquire, the more advisers break away, creating a cycle of constant regeneration.

This trend is already established across the pond in the US, where PE-fuelled acquisition has been taking place far longer, with much more firepower than the UK. The result is that for every one adviser firm acquired, 1.5 new firms spring up. As David Winokur of PE firm Clayton, Dubilier & Rice said:

"‘In our estimation, it’s going to be around 35 years until this industry reaches a saturation point in terms of the point where it’s overconsolidated. We have 15,000 registered RIAs in this country. For every one RIA that gets consolidated, one-and-a-half new RIAs are formed. It’s a pretty extraordinary level of regeneration and growth in the channel. “

The Cobra Effect is alive and well in the UK advisory space. As long as PE capital keeps flowing, entrepreneurial advisers will continue to set up new firms—some of which will end up being bought by consolidators, only for the cycle to repeat.

Consolidators still haven’t cracked the code for growing and retaining their own advisers or significantly improving productivity through technology. Even if they do, their best advisers will quickly realise they can create more value for their clients—and themselves—by building their own businesses. And so the cycle continues.