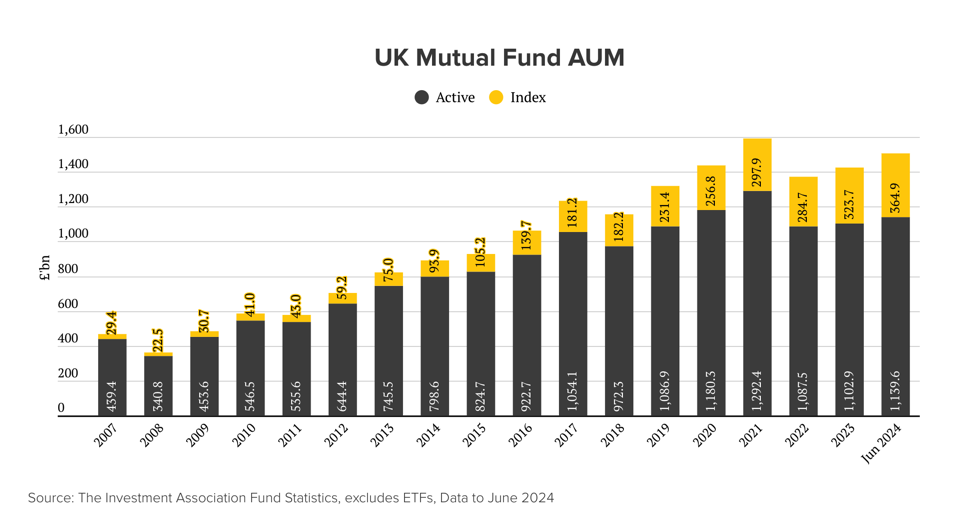

When Vanguard arrived on these shores in 2009, index funds accounted for a mere 6% of the £485bn managed by UK asset managers, according to data from the Investment Association. Even worse, index funds made up a paltry 2% of net retail flow that year. But if you thought the timing couldn’t possibly be right, you’d be mistaken. UK investors were reeling from the aftermath of the Great Financial Crisis, and the promise that active management would protect them during market downturns had been laid bare. Investors were more receptive to a different way of investing.

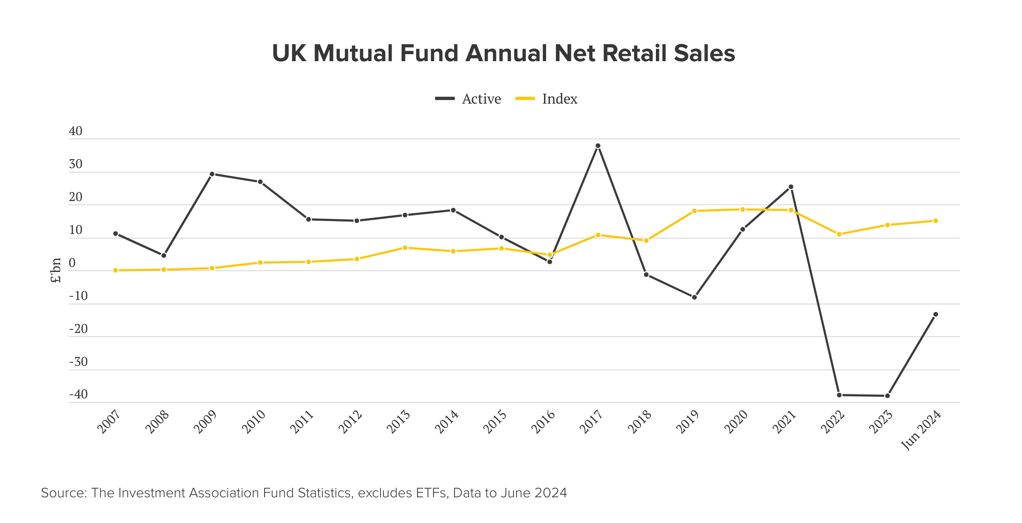

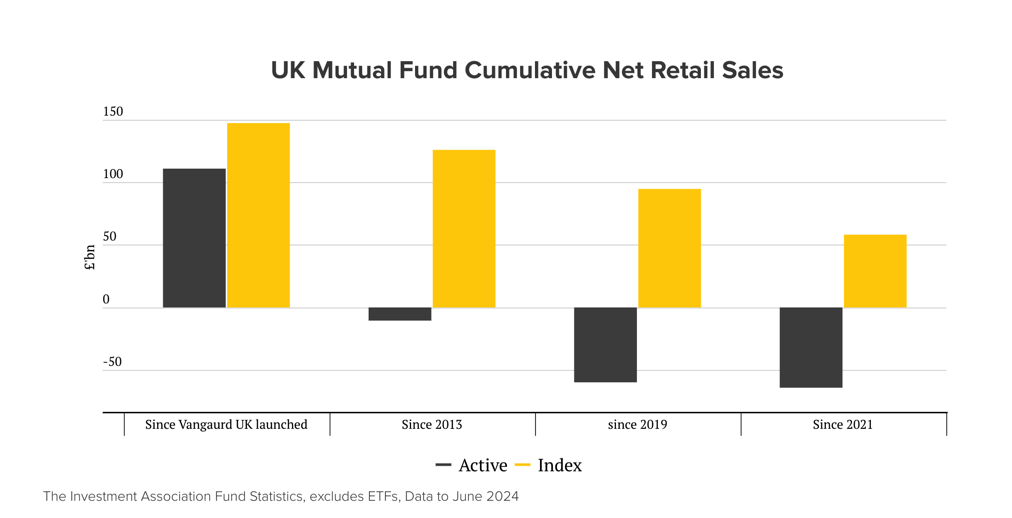

Slowly but surely, investors began to warm up to index funds. However, it took another five years for index funds to reach 10% of assets under management (AUM) by 2014. During this period, index funds accounted for about 20% of net retail fund flow. Index funds gained even more popularity over the subsequent eight years, ending 2022 with a 20% share of AUM. Remarkably, index funds took in over £7 of every £10 of net retail inflow during this time.

What’s happened in the last 18 months to June 2024, though, has been nothing short of extraordinary. Index funds rose 25% of total £1.5 trillion assets in the UK mutual funds. Investors pulled over £50bn from UK active funds, while £29bn of net new money flowed into index funds. It seems Mr. and Mrs. Miggins have had enough of the obfuscation of stock pickers and are voting with their money.

Asset managers are deluding themselves if they think this is a short-term trend. Since 2018, the UK Index fund has outsold active funds every single year bar one. The cumulative net retail sales for active funds over the last five years stand at -£60bn, while £95bn has been invested in index funds. Even over a 10-year period, net retail sales for active funds are at -£10.5bn, compared to a whopping £126bn in index funds. Yes, you read that right. The cumulative net retail sales for UK active funds are -£10.5bn in the past decade. They haven’t taken in a single penny, net of withdrawals, from retail investors in ten years.

Bull Market Subsidy

You must be wondering: If active funds are hemorrhaging money, how have their total assets nearly doubled in the past decade?

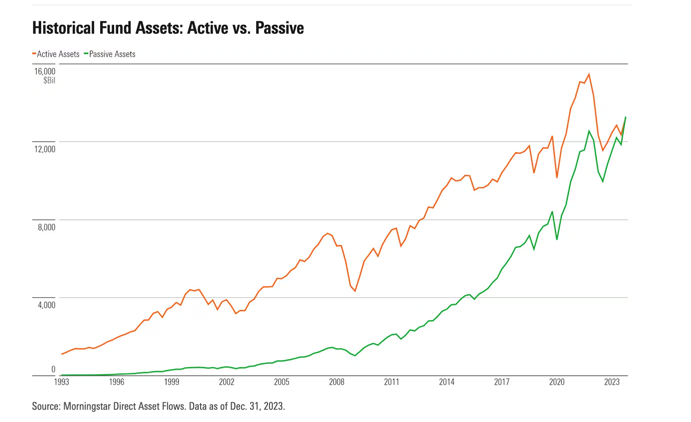

This mystery is what Eric Balchunas refers to in his book The Bogle Effect as the “Bull Market Subsidy,” which he illustrates with how index funds gained market share in the US.

‘…there is one big difference between asset management and the music business (or any other business, for that matter). Almost every industry out there has to rely on sales made for revenue and survival, whereas in the asset management industry, your revenue can grow simply because the market went up, as I mentioned earlier. We call this unusual phenomenon the Bull Market Subsidy because it really is like being subsidized. Even if asset managers lose customers, they can still make more money.

While active mutual funds’ slice of the pie is shrinking via flows (which is what most of the media focuses on), the entire pie keeps growing. Active’s slice can shrink so long as the pie itself keeps growing. And the pie grows not because the asset management expanded the business to new customers but because stocks and bonds simply have much higher prices today. And the asset managers get a percentage of that pie. If the pie grows faster than your slice shrinks relative.

For example, the market share of passive funds increased from 2% in 1993 to 43% in 2020. In any other industry, that would mean active’s business would be nearly cut in half. But instead, active’s assets grew from $1.5 trillion in 1993 to $13.3 trillion in 2020. Here’s where it gets mind-boggling: In 2010, active equity mutual funds had about $3 trillion in assets. During the next ten years, they saw $2.3 trillion in outflows, yet ended up with more than $5.5 trillion—nearly double the assets and double the revenue. So today, every time the stock market goes up 1%, it raises the total assets of active funds by roughly $70 billion and their revenue by $410 million.

This is why a prolonged bear market—or 2008-style downturn—is easily the biggest risk for Wall Street, as the asset mirage will crumble without any real customer base to fall back on because much of it has been eaten away by the Bogle Effect during the last twenty years. In short, the Bull Market Subsidy will turn into a Bear Market Tax. This on top of any existing investors in the funds leaving in a panic. It will get ugly. There will be blood. ‘

Such is the power of the AUM revenue model that though active managers are hemorrhaging money and clients on a net basis, they receive a natural uplift simply from being invested in the market. And while they tend to scaremonger index investors about the potential risks of a bear market, it is their own revenue and very existence that are most threatened by a big bad bear market.

Where have we seen this movie before?

Fund houses seem entirely at a loss as to how to reverse this trend of negative fund flows. Nearly every time this topic comes up, you can count on someone to counter with a straw man argument about how ‘index funds are getting too big and distorting the markets’ or how investors will ‘come back to their senses when the next bear market comes around.’

It’s just pathetic. Many are pinning their hopes on a bear market to turn the tide. But evidence from across the pond suggests that once net inflows favour index funds, not even a big bad bear can reverse it. In fact, the opposite has proven true: after every bear market over the past 25 years, investors have realised that active management fails to deliver the downside protection it promises, prompting them to flock to index funds.

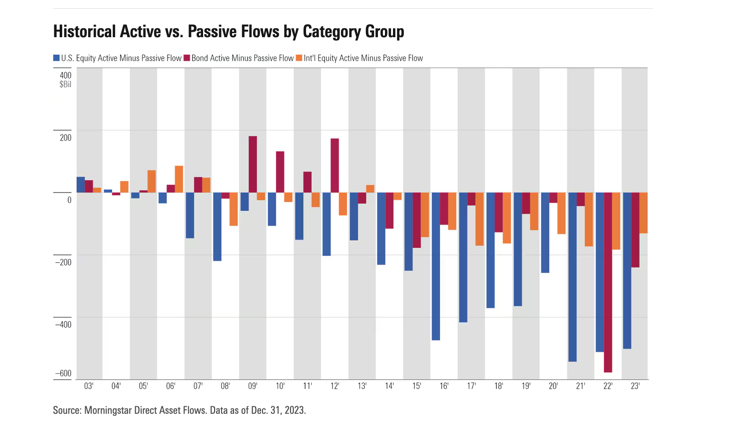

Total assets in US index strategies surpassed those in active ones for the first time in 2023, according to Morningstar.

As Morningstar notes, ‘Active bond funds pulled in more dollars on a net basis than passive counterparts for years until 2013. They haven’t achieved that feat in a calendar year since. International-equity fund flows began favoring passives in 2008, and U.S. equity fund flows first turned that way in 2005. It’s been one-way traffic over the past decade.’ (1)

Even anecdotal evidence in the UK shows that while active investors bailed during the 2020 COVID crash and the challenging market of 2023, index investors continued to add new money through these downturns. It turns out, retail money isn’t nearly as ‘dumb’ as The City would have you believe. For the most part, index investors are heeding Jack Bogle’s advice to ‘stay the course.’

It took 30 years for index funds to grow from 2% to over 50% market share in the US, with more than half of this growth occurring in just the last decade. The UK is on a similar trajectory, with index funds increasing their market share from 6% to 25% in the past 15 years alone.

Over the last 10 years, the total fund industry AUM has grown by 5.5% annually to £1.5 trillion. However, active fund AUM has grown by a mere 3.6% annually, compared to a robust 14.8% for index funds. At this rate, my money is on index funds overtaking active funds in the UK over the next decade.

References:

- Morningstar, Jan 2024: It’s Official: Passive Funds Overtake Active Funds https://www.morningstar.com/funds/recovery-us-fund-flows-was-weak-2023